Silver as Nishab Zakat to Improve Community Welfare in the Modern Era

DOI:

https://doi.org/10.61455/deujis.v1i02.24Keywords:

zakat, money, silver nishab, society, modern eraAbstract

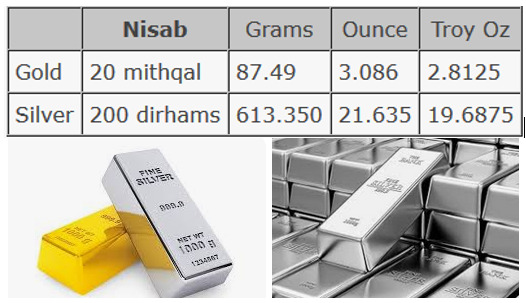

This study aims to analyze the zakat nishab of currency using the silver nishab or gold standard. Because so far most Indonesian people use Golden Nishob. Data collection was carried out using data from various references from trusted scholars' books. The method used in this study uses a normative-descriptive approach in a rational, empirical and systematic way. Based on the results of analysts, it was concluded that Nishab Zakat money is equated with silver worth 595 grams. Measuring money zakat nishab with silver zakat nishob is not arbitrary, but also refers to the opinions of authoritative scholars, because it will have a positive impact and benefit for the community, and can optimize the potential of Muslims to zakat to be more prospective and progressive.

References

Saprida, “Pemahaman Dan Pengamalan Kewajiban Zakat Mal,” Econ. Sharia, vol. 01, no. 01, pp. 49–58, 2015.

F. A. Hudaefi, R. E. Caraka, and H. Wahid, “Zakat administration in times of COVID-19 pandemic in Indonesia: a knowledge discovery via text mining,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 2, pp. 271–286, 2022, https://doi.org/10.1108/IMEFM-05-2020-0250.

M. Syahbandir, W. Alqarni, M. A. Z. Dahlawi, A. Hakim, and B. Muhiddin, “State Authority for Management of Zakat, Infaq, and Sadaqah as Locally-Generated Revenue: A Case Study at Baitul Mal in Aceh,” Al-Ihkam J. Huk. dan Pranata Sos., vol. 17, no. 2, pp. 554–577, 2022, https://doi.org/10.19105/al-lhkam.v17i2.7229.

A. El Ashfahany, A. D. N. Hidayah, L. Hakim, and M. S. Bin Mohd Noh, “How Zakat Affects Economic Growth In Three Islamic Countries,” J. Islam. Econ. Laws, vol. 6, no. 1, pp. 45–61, 2023, https://doi.org/10.23917/jisel.v6i1.21242.

S. Maryam, A. Alfida, and F. Rianti, “A Scientometrics Analysis of Publication Mapping in Sharia Economics and Finance in Indonesia and Malaysia,” Int. J. Inf. Sci. Manag., vol. 21, no. 2, pp. 1–18, 2023, https://doi.org/10.22034/ijism.2023.1977597.0.

Z. Abidin, “Manifestasi dan Latensi Lembaga Filantropi Islam dalam Praktik Pemberdayaan Masyarakat : Suatu studi di Rumah Zakat Kota Malang,” J. Stud. Masy. Islam, vol. 15, pp. 197–214, 2012.

B. Ismiati, “Metodologi Pemikiran K . H . Sahal Mahfudh tentang Penetapan Zakat Uang Kertas,” J. Ekon. Syariah Indones., vol. IX, no. 23, pp. 127–137, 2019.

Amrin, Ade Irmah Imamah, Nurrahmania, and A. Priyono, “Implementation of Professional Zakat of State Civil Apparatus in Indonesian in Islamic Law Perspective,” Profetika J. Stud. Islam, vol. 24, no. 01, pp. 22–32, 2023, https://doi.org/10.23917/profetika.v24i01.709.

M. Ichsan, “The Use of Gold Dinar and Silver Dirham in Moslem Countries in the Contemporary Era,” J. Media Huk., vol. 24, no. 1, pp. 35–41, 2017, https://doi.org/10.18196/jmh.2017.0087.35-41.

S. Halilah, “Zakat Emas dan Perak Serta Cara Perhitungannya,” Siyasah J. Huk. Tata Negara, vol. 4, no. 1, pp. 47–61, 2021, [Online]. Available: http://www.ejournal.an-nadwah.ac.id/index.php/Siyasah/article/view/265

Nurrudin, “Dalam Mewujudkan Ketangguhan,” Transfpemasi Hadits-hadits Dalam Mewujudkan Ketangguhan Ekon. Pada Era Mod., vol. 01, p. 2, 2014.

M. Muklisin, “Ikhtiar menjadikan dinar-dirham sebagai mata uang di indonesia,” Equilibrium, vol. 1, no. 2, pp. 258–278, 2013.

E. Willya, A. B. B. Maronrong, and S. Mokodenseho, “The Enforcement of MUI Fatwa Number 1 of 2003 concerning Copyright for Merchants Selling Pirated VCD and DVD in Manado City,” Al-Ahkam, vol. 31, no. 2, pp. 183–202, 2021, https://doi.org/10.21580/ahkam.2021.31.2.8638.

S. N. Azizah, “The adoption of FinTech and the legal protection of the digital assets in Islamic/Sharia banking linked with economic development: A case of Indonesia,” J. World Intellect. Prop., 2023, https://doi.org/10.1111/jwip.12257.

F. Wahyudi, “Mengontrol Moral Hazard Nasabah Melalui Instrumen Ta’Zir Dan Ta’Widh,” Al-Banjari J. Ilm. Ilmu-Ilmu Keislam., vol. 16, no. 2, p. 25, 2017, https://doi.org/10.18592/al-banjari.v16i2.1357.

Sugiyono, Metode Penelitian Kuantitatif, Kualitatif, Dan R & D . Bandung: Alfabet. Cet.14, 2011.

B. M. Sugiyanto, A. Anshori, and M, “Implementasi Pembelajaran Al-Qur’an Metode Littaqwa Di Sdit Nur Hidayah Surakarta Dan Metode Karimah Di Mi Nurul Karim Karanganyar Tahun Ajaran 2019/2020,” Profetika J. Stud. Islam, vol. 21, no. 1, pp. 86–95, 2020, https://doi.org/10.23917/profetika.v21i1.11062.

Sugiono, Metode Penelitian Bisnis Pendekatan Kualitatif, Kuantitatif dan R&D. Bandung: Alfabeta, 2018.

Lexy J. Moleong, Metode Penelitian Kualitatif. Bandung: Remaja Rosdakarya, 2006.

Noeng Muhadjir, Metode Penelitian. Jakarta: Acamedia.edu, 2006.

I. SGunawan, Metode Penelitian Kualitatif. 2016, pp. 1–27. [Online]. Available: http://fip.um.ac.id/wp-content/uploads/2015/12/3_Metpen-Kualitatif.pdf

Moh. Nazir, Metode Penelitian. Bandung: Ghalia Indonesia, 2003.

Samsu, Metode Penelitian (Teori & Aplikasi Penelitian Kualitatif, Kuantitatif, Mixed Methods, serta Research and Development), no. July. Jambi: Pustaka Jambi, 2020.

G. R. Somantri, “Memahami Metode Kualitatif,” Makara Hum. Behav. Stud. Asia, 2005, https://doi.org/10.7454/mssh.v9i2.122.

C. Williams, “Research Methods,” J. Bus. Econ. Res., vol. 5, no. 3, pp. 65–72, 2007.

S. Shobron and T. Masruhan, “Implementasi Pendayagunaan Zakat Dalam Pengembangan Ekonomi Produktif Di Lazismu Kabupaten Demak Jawa Tengah Tahun 2017,” Profetika J. Stud. Islam, vol. 18, no. 1, pp. 55–63, 2017, https://doi.org/10.23917/profetika.v18i1.6340.

R. F. Fakultas, “Building People’s Economic Empowerment In Shari’ah Constellation: An Overview Of The Role Of Zakat At The Micro And Macro Levels,” In Batusangkar International Conference Ii, October 14-15 2017, 2017, Pp. 263–268.

K. Hayati, “Model Of Poor Society Empowerment Through Optimizing The Potential Of Zakat: A Case Study in Lampung Province,” J. Indones. Econ. Bus., vol. 27, no. 2, pp. 174–191, 2015, https://doi.org/10.22146/jieb.6245.

M, Nuha, “Kontekstualisasi Makna Zakat: Studi Kritis Kosep Sabilillah Menurut Masdar Farid Mas’udi,” in The 3rd University Research Colloquium 2016, 2016, pp. 185–191.

D. Hafidhuddin, “Peran Strategis Organisasi Zakat Dalam Menguatkan Zakat Di Dunia,” Al-Infaq J. Ekon. Islam, vol. 2, no. 1, pp. 1–4, 2019, [Online]. Available: http://www.jurnalfai-uikabogor.org/index.php/alinfaq/article/view/361/256

M, “Didin Hafidhuddin’s Leadership Style in Managing National Zakat Agency (Badan Amil Zakat Nasional),” in ICONESS 2021, July 19, Purwokerto, Indonesia, Belanda: EAI, 2021, pp. 1–7. https://doi.org/10.4108/eai.19-7-2021.2312707.

B. A. B. Ii, “Kajian Penerapan Zakat ..., Farid Wajdi, FISIP UI, 2008”.

A. A. Munawar Albadri and R. Amaliah, “The Effect of Zakat, Infaq and Shadaqah Management on Community Economic Empowerment in Baznas, Cirebon,” SSRN Electron. J., no. 8, pp. 1–10, 2019, https://doi.org/10.2139/ssrn.3339714.

M, “The Effect of Leadership and Islamic Work on Employee Performance : A Study at the Amil Zakat Institution in Surakarta,” Atlantis Press SARL, 2022, pp. 20–21. https://doi.org/10.2991/978-2-38476-022-0.

S. Humaidi. M, “Tarjihat Imam Abi Qosim,” Profetika, vol. 19, no. 1, pp. 67–83, 2018, https://doi.org/10.23917/profetika.v19i1.8084.

A. Amrin, K. Khairusoalihin, and M. Muthoifin, “Tax Modernization in Indonesia: Study of Abu Yusuf’s Thinking on Taxation in the Book of Al-Kharaj,” Profetika J. Stud. Islam, vol. 23, no. 1, pp. 30–42, 2021, https://doi.org/10.23917/profetika.v23i1.16792.

W. Nopiardo, “Urgensi Berzakat Melalui Amil Dalam Pandangan Ilmu Ekonomi Islam,” JURIS (Jurnal Ilm. Syariah), vol. 15, no. 1, p. 85, 2017, https://doi.org/10.31958/juris.v15i1.491.

A. Z. Mubarok, “Model pendekatan pendidikan karakter di pesantren terpadu,” Ta’dibuna J. Pendidik. Islam, vol. 8, no. 1, p. 134, 2019, https://doi.org/10.32832/tadibuna.v8i1.1680.

A. G. Ihsan, “Pengembangan Ilmu Ushul Al Fiqh,” Al-Ahkam J. Ilmu Syariah dan Huk., vol. 2, no. 2, 2017, [Online]. Available: https://doi.org/10.22515/alahkam.v2i2.1069

N. Kurnia Putra, A. Amrin, M. M. Abu Zinah, M. Masuwd, and S. Subhan, “Consumption from an Islamic Economic Perspective: Study of Quranic Verses on Consumption,” Demak Univers. J. Islam Sharia, vol. 1, no. 01, pp. 37–45, Feb. 2023, https://doi.org/10.61455/deujis.v1i01.21.

Y. Muhammad Thaib, R. Mahmoud ELSakhawy, M, and T. Al-Mutawakkil, “Marriages of More Than Four and its Impacts on Community Perspective of Islamic Law and Indonesian Law,” Demak Univers. J. Islam Sharia, vol. 1, no. 02, pp. 67–82, Aug. 2023, https://doi.org/10.61455/deujis.v1i02.8.

M. S. Apriantoro, Yasir Hasanridhlo, Widhi Indira Laksmi, Leny Agustin, and M. Z. Husain, “A Barter System for Used Palm Oil Traders: Islamic Law Perspective,” Demak Univers. J. Islam Sharia, vol. 1, no. 01, pp. 57–66, May 2023, https://doi.org/10.61455/deujis.v1i01.34.

U. K. Pati, Pujiyono, and Pranoto, “Sharia Fintech as a Sharia Compliance Solution in the Optimization of Electronic-Based Mosque’s Ziswaf Management,” Padjadjaran J. Ilmu Huk., vol. 8, no. 1, pp. 47–70, 2021, https://doi.org/10.22304/pjih.v8n1.a3.

M. Sa’adah and U. Hasanah, “The Common Goals of BAZNAS’ Zakat and Sustainable Development Goals (SDGs) according to Maqasid Al-Sharia Perspective,” Al-Ihkam J. Huk. dan Pranata Sos., vol. 16, no. 2, pp. 302–326, 2021, https://doi.org/10.19105/al-lhkam.v16i2.4990.

Afridatul Rukmana, “Biografi dan Pemikiran Dididn Hafidhuddin Tentang Zakat Perusahaan,” 2013. https://doi.org/10.1017/CBO9781107415324.004.